starting credit score canada

Credit Score for Newcomers in Canada. Credit risk is the likelihood youll pay your.

Everything You Need To Know About Credit Scores Canada Drives

A credit score is essentially a numeric rating that banks lenders use to qualify you for a loan.

. A credit score helps lenders evaluate your credit profile and influences the credit thats available to you including loan and credit card approvals interest rates credit limits and. Ad LifeLock Alerts You to Activity Around Your Social Security Number in Their Network. As a new immigrant in Canada the phrase Credit Score might be very new to you.

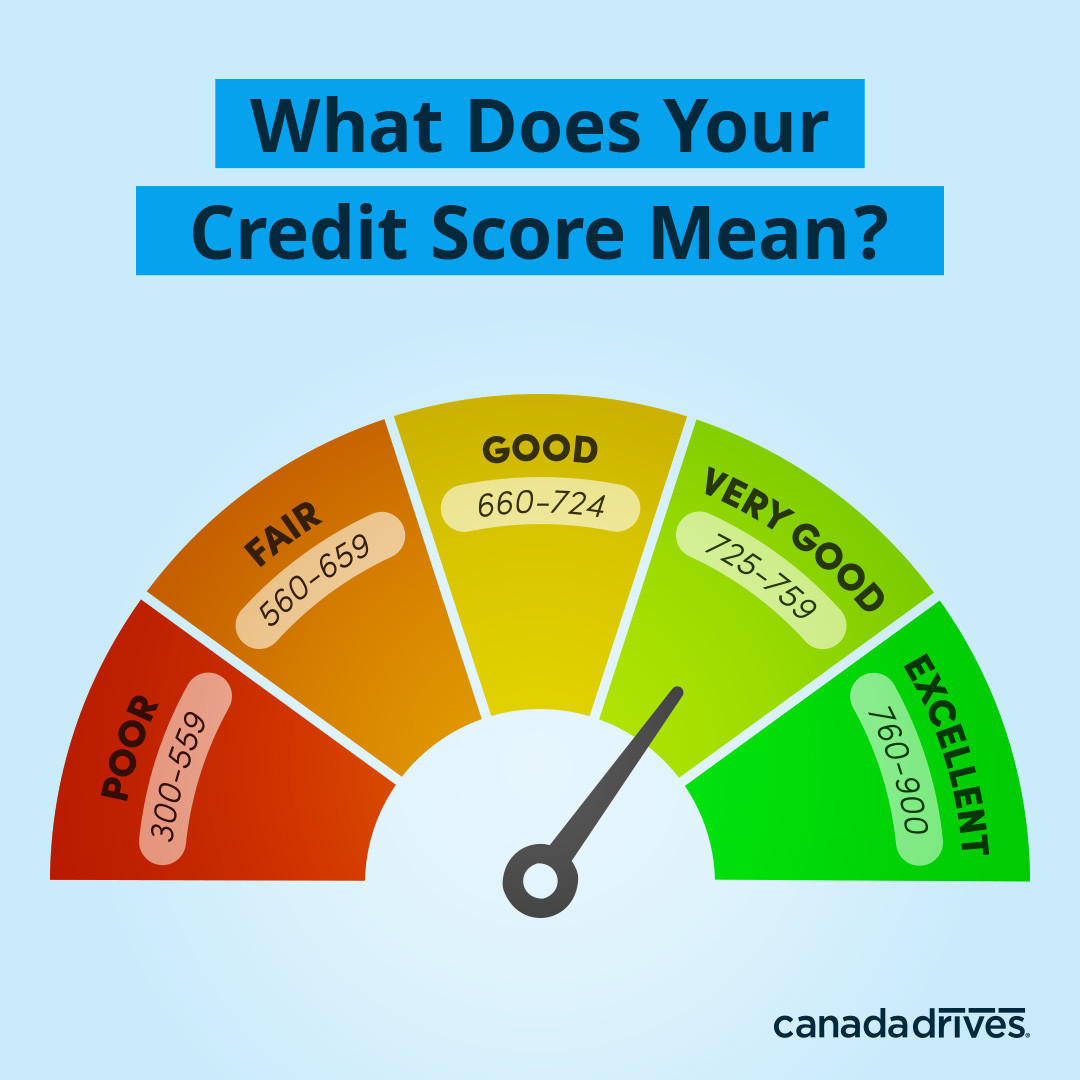

The ranges on the good side of things are. A credit score is a number generally between 300 and 900 that helps determine your creditworthiness. Good 660 724 Very Good 725 759 and Excellent 760 900.

If you want to get a good deal on a credit card. Credit scores range from 300 just getting started 650. Anything over 780 is considered excellent.

But its highly unlikely your first credit score will be. Your credit score is a number between 300 and 900 that tells lenders in Canada how trustworthy you are as a borrower. This is because a lender may give more weight to certain information when calculating.

Sign Up for a 30 Day Trial Today. Ad Includes Full Instant Access To Your Report Score Plus Credit Monitoring Simulation. This is because this type of system probably does not exist in the.

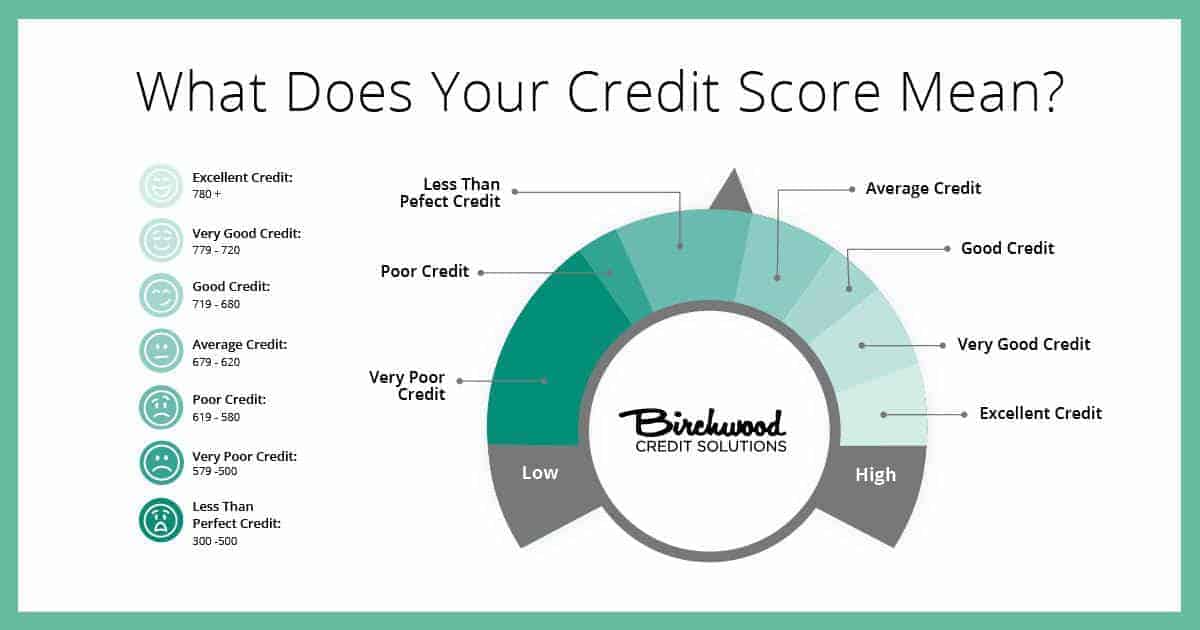

TransUnion suggests that you should be able to qualify for a loan if you have a. Your credit score is a three-digit number between 300 and 900 that represents your credit risk. The higher your score the more likely youll get approved for credit and at.

What is a credit score. On average any credit score of 680 or above is considered a good and. Easily Dispute Any Errors In Your Credit Report.

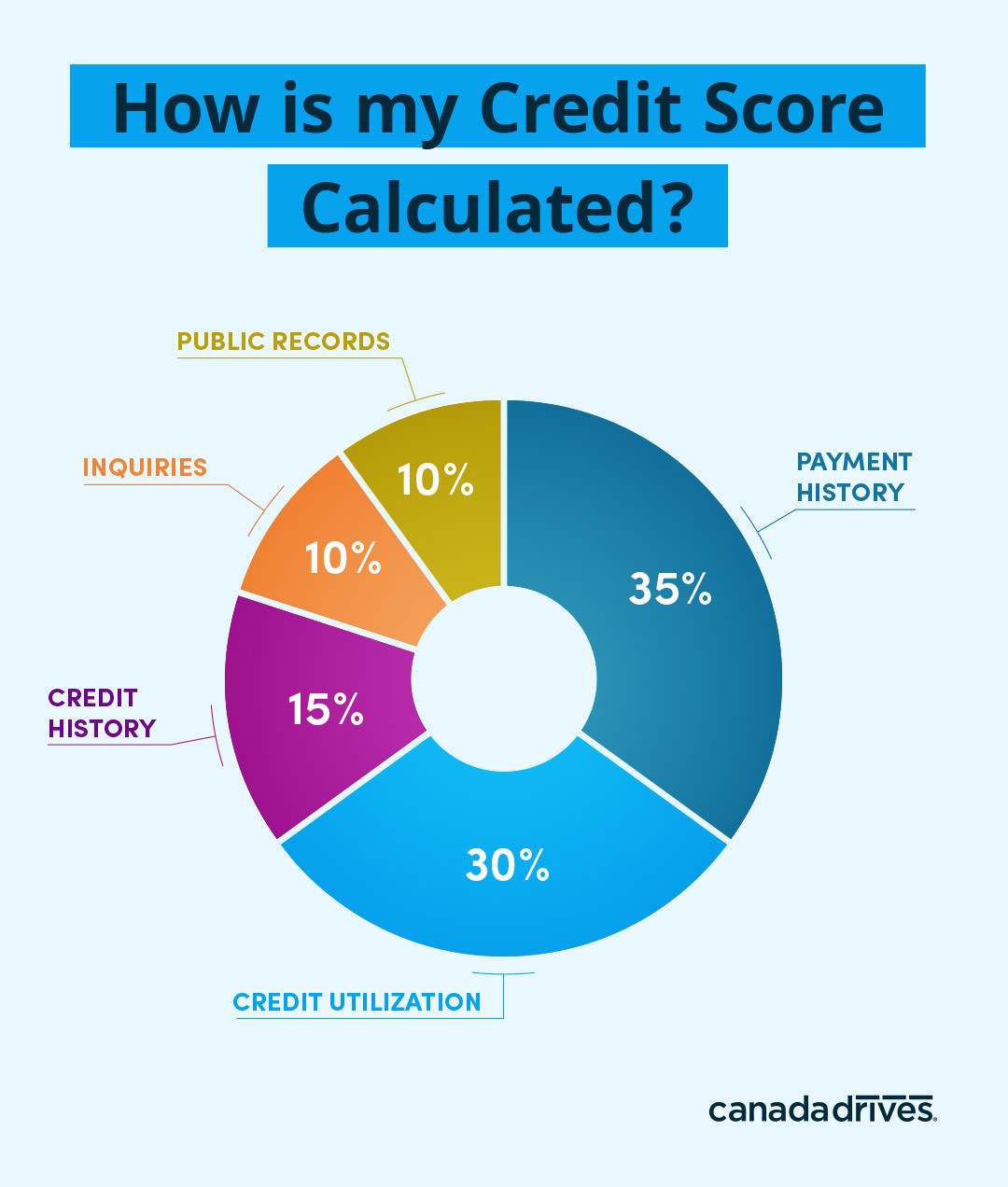

Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a credit card. 35 of your credit score is based on. The top score in Canada is 900 points which is about the level of credit you can get at any time.

In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In. Credit scores are calculated using information in your credit report including. Most peoples credit score doesnt start at the bottom of the scale.

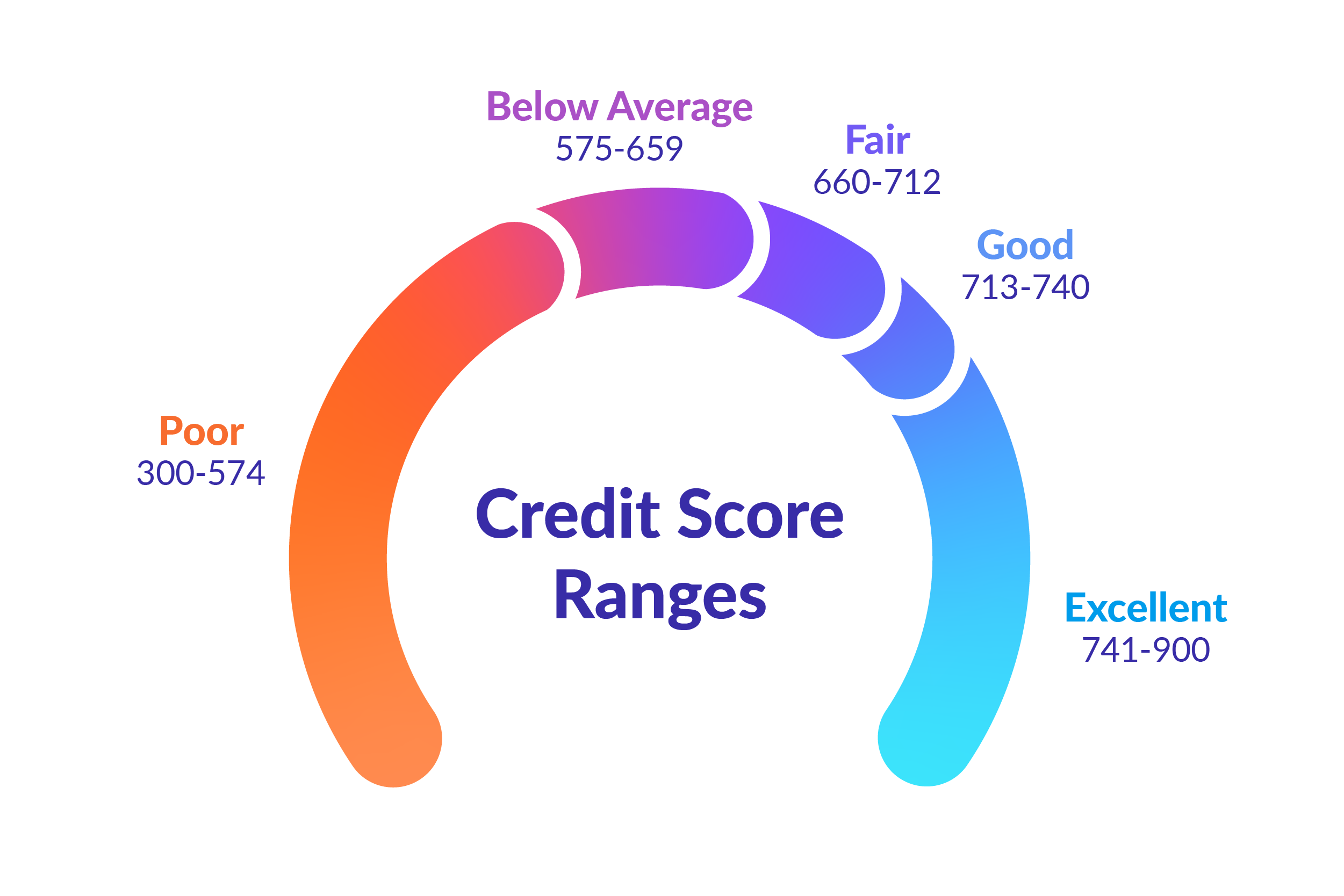

Once you begin to establish a credit history you might assume that your credit score will start at 300 the lowest possible FICO Score. Canadian credit scores vary between 300 to 900 and represent your likelihood to repay debt on time. Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a mortgage credit.

What is the credit score range in Canada. Pay your credit card bill on time. Since credit scores range from 300 850 300 could be considered the starting score.

1 What is a credit score in Canada. Scores above 660 typically mean youre low-risk and shouldnt have. If youre under 620 your credit is considered poor.

Whether paying the minimum or more make your credit card bill payments on or before the due date. A good credit score in Canada is 660 or higher. Cybercriminals Find New Ways to Steal Identities.

However when you order your credit score it may be different from the score produced for a lender. Credit scores are a number between 300 and 900 that serve as a reflection of your credit report and trustworthiness.

How To Increase A Credit Score To 800 5 Proven Tips Improve Credit Score Credit Score Improve Credit

Grow Credit Review Starter Credit Card To Build Credit In 2022 Credit Review Build Credit Credit Card Design

5 Top Methods To Raise Your Credit Rating Fast Credit Score Improve Credit Score What Is Credit Score

Why Do Credit Scores Differ Infographic Credit Score Infographic Finance Infographic Credit Score

10 Professional Habits You Should Have Money Mindset Habits Career Goals

Everything You Need To Know About Credit Scores Canada Drives

Credit Score Range What Is The Credit Score Range In Canada

The Ultimate Guide To Credit Scores In Canada Borrowell

How To View Your Credit Report And Credit Score For Free Credit Score Equifax Credit Report Credit Bureaus

Understanding Your Credit Score And Why It Matters Valley First

Credit Score Range What Is The Credit Score Range In Canada

Credit Score Explained So You Know Exactly How To Get A Credit Score Of 800 Or Higher This Article Improve Credit Score Improve Credit Increasing Credit Score